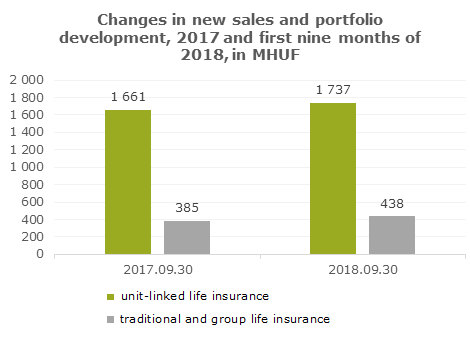

Today CIG Life Insurance plc. published its unaudited consolidated report, in accordance with the international financial standards, with its 2018 Q3 financial data. The Group level profit after tax is 1.561 BHUF; the total comprehensive income is 508 MHUF profit; and the profit per share for the three quarters is 19 HUF. Income from insurance revenues reached 17.048 BHUF in the first nine months of 2018. In the life segment, new acquisitions are 2.175 BHUF, which represents a 6 per cent increase year on year compared with 2017.

For life insurance contracts sold this year, the performance of CIG Pannónia’s own sales network constitutes 29 per cent, while the share of the independent broker channel was 39 per cent, the banking channel’s 22 per cent, and that of other business development was 10 per cent of new sales. Channel diversification continued in the life segment. After the development of the banking sales channel, call center sales have been launched in cooperation with a significant sales partner.

Portfolio clearance continued in the non-life segment, as well as the run-off of the retail casco portfolio. This explains the 263 MHUF decrease in the net portfolio development during the first three quarters. In the first nine months of the year, the non-life segment reached a 567 MHUF profit after tax, which is an excellent result, similarly to that of previous quarters.

In 2018 the corporation’s equity increased from the 2017 year-end 9.015 BHUF to 16.803 BHUF, i.e. by 86 per cent. The Solvency II capital adequacy of CIG Pannónia’s life insurance segment is 349 per cent, while it is 176 per cent in the non-life insurance segment, so it complies with the minimum 150% capital adequacy level expected by the Supervisor.